Truth really is stranger than fiction—and, in the estate world, far more expensive.

What Happened?

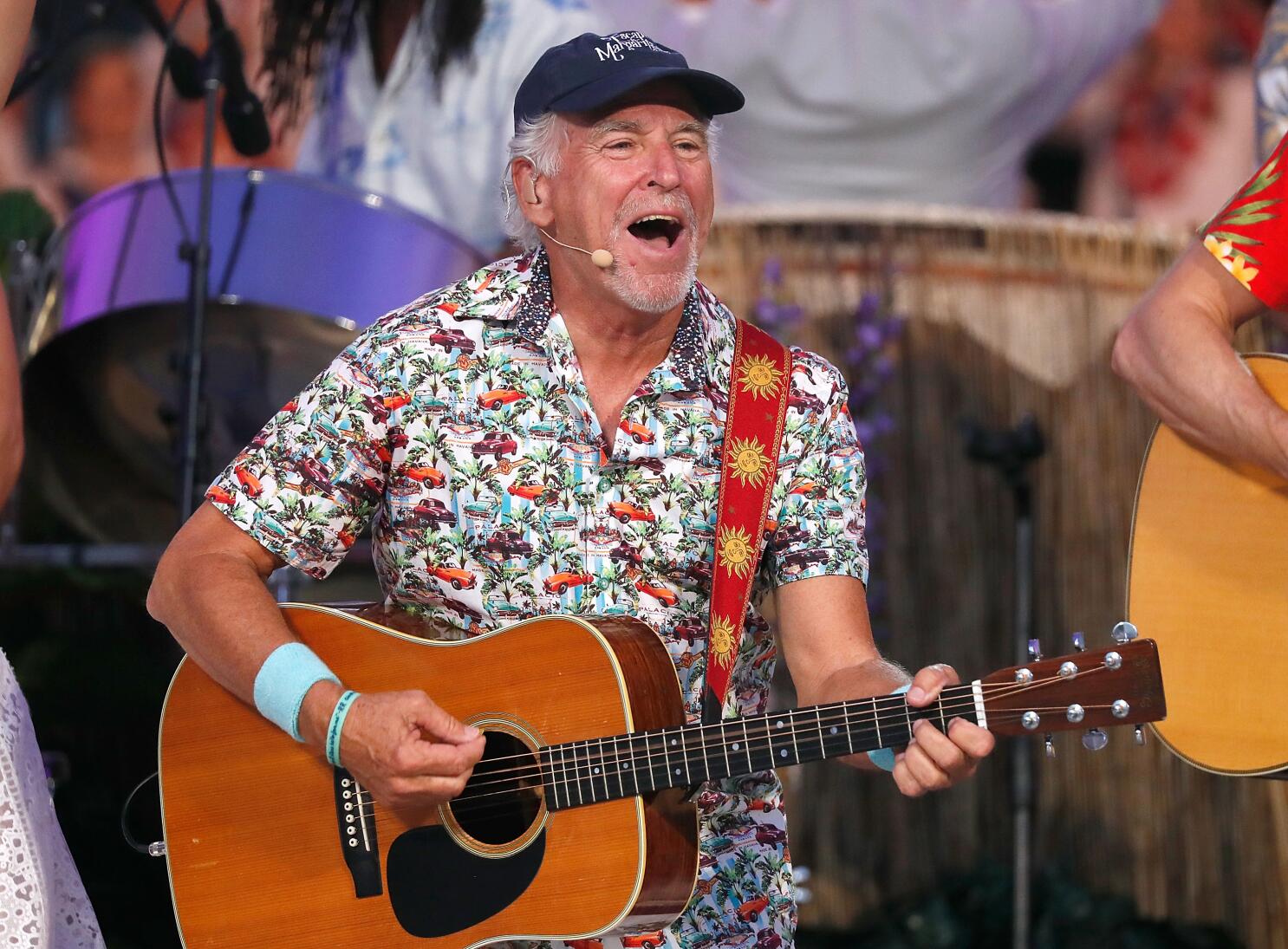

This week—barely eighteen months after Jimmy Buffett’s death—his widow Jane filed a petition in Los Angeles Probate Court to remove longtime adviser Richard Mozenter as co-trustee of the couple’s $275 million marital trust.

- Jane says Mozenter stonewalled her requests for financial data for more than a year, finally delivering a projection that pegged her annual income at under $2 million—less than a one-percent return on a famously lucrative empire that includes a 20 percent stake in Margaritaville-branded hotels, cruise lines, and retirement villages.

- She also alleges “open hostility,” dismissive emails, and payments of over $1.75 million in fees billed since Buffett’s death.

- Mozenter hit back the same week in a Florida filing, accusing Jane of meddling and asking a Palm Beach judge to remove her instead.

Neither lawsuit has gotten into my hands yet, but some things are already clear based on the news reports. You have two co-fiduciaries, two states, and a tabloid-ready slug-fest: this is exactly what most families hope their estate plan will prevent!

Nine Ways a Thoughtful Trust Could Have Kept the Fins Out of the Water

Below are field-tested strategies to use — whether the clients are young parents or ultra-high-net-worth entrepreneurs—to keep an estate from washing up in court. No single idea alone will solve every problem, but together, they can form a sturdy breakwater against the waves of grief, money, and clashing personalities.

1. Pick Fiduciaries for Chemistry, Not Just Credentials

Blending a surviving spouse with a business manager can work beautifully—when they respect each other’s roles. Before you sign:

- Interview the prospective professional without your spouse in the room. Probe communication style, update frequency, and willingness to explain numbers in plain English.

- Stagger start dates. Give the widow or widower six to twelve months as sole trustee so cashflow triage isn’t clouded by a power dynamic.

- Consider a corporate co-trustee. Trust companies charge a published schedule, are audited, and don’t take disagreements personally. It’s just business.

2. Hard-Code Transparency

Jane’s core complaint is that she’s in an information vacuum. A trust can require things like:

- Quarterly balance sheets and cash-flow statements delivered within 30 days of quarter-end.

- A plain-language cover letter that answers, “Can I maintain my lifestyle for life?”

- An Investment Policy Statement (IPS)—risk tolerance, target allocation, and rebalancing rules—attached as an exhibit.

When reporting is a contractual duty, silence becomes a breach, not just a gray area.

3. Private, Quick, Cheap Dispute Paths

There may be robust provisions regarding dispute resolution in the Buffett trust, but optically, it appears to steer conflict straight into open court. Some ways for others to avoid this include:

- Mandatory mediation within 30 days of a written dispute notice.

- Optional binding arbitration if mediation fails.

- A tie-breaker authority—sometimes vested in a trust protector—to settle routine stalemates (e.g., approving an audit or signing a property sale). A protector isn’t always essential, but as a neutral referee it can keep small sparks from becoming wildfires.

Notice the order here: courts are the last resort, not the first.

4. Removal & Succession Written in Plain English

State statutes let judges remove trustees for hostility or neglect, but a document can go further:

- Objective triggers (missed reporting deadlines, failed audit, incapacity).

- Cure period (15 days to respond, 30 days to cure).

- A succession ladder naming one or two back-ups so you don’t scramble under duress.

With a ladder in place, Jane could have stepped over Mozenter rather than suing him.

5. Up-Front Fee Schedule

Mozenter’s invoices total almost two million dollars. A flat fee schedule—for instance, 0.70 % on the first $5 million, sliding down thereafter, plus hourly rates for special projects—keeps sticker shock off the table and aligns expectations before grief and distrust enter the chat.

6. Business-Asset Governance

Margaritaville isn’t some Vanguard index fund. Operating agreements and the trust must dovetail so the machine keeps humming even if trustees feud.

- Voting proxies allow trustees to appoint a temporary corporate director during disputes.

- Liquidity options (buy-sell, redemptions, or dividend floors) give a surviving spouse certainty without demanding a fire-sale.

7. Family-Governance Meetings

Good numbers without context still feel like hieroglyphics. I urge high net worth clients to host an annual “state-of-the-trust” weekend: financial presentation, Q&A, and transparent minutes. It’s far easier to ask, “What happens if you two disagree?” over coffee than through subpoenas.

8. Plan Reviews After Every Big Liquidity Event

Buffett wrote his first trust in 1990—long before Margaritaville at Sea or $400-a-night resort suites. Bake automatic reviews into documents: selling a company, buying a jet, or exceeding a net-worth milestone? Meet, update, and sign.

9. Right People, Right Roles

Finally, remember that trustees are managers; beneficiaries are consumers; trust protectors (if used) are referees; and family advisers (lawyers, CPAs, investment consultants) supply the data. Keeping those lanes clear is the single best hedge against bruised egos and court filings.

Could a Trust Protector Have Saved the Day?

Maybe—as one tool in a larger kit. A protector empowered to remove a hostile trustee, compel an audit, or order mediation could have offered a pressure-release before petitions flew coast to coast. But even the best protector clause can’t rescue a plan that skimps on reporting, ignores personality fit, or never revisits outdated terms. Think of a protector as the circuit breaker, not the wiring diagram.

Parting Wisdom—And a Gentle Nudge

My legendary wills and trusts professor, Charlie Whitebread, told us on the first day of class that gifts, wills, and trusts could be boiled down to two words: “death……and greed.” Jimmy Buffett spent a career turning “island time” into a nine-figure lifestyle brand. Yet his estate shows that wealth alone can’t buy peace. That comes from candid conversations, unglamorous documentation, and a willingness to stress-test roles before tragedy strikes.

If your own plan:

- Predates a major liquidity event

- Names co-fiduciaries who have never worked together

- Lacks written reporting standards or private dispute clauses

…then the time to update is now, not after loved ones end up filing lawsuits.

Nothing here is legal advice; every family and every fortune is different. But if you’d like a seasoned guide to shore up your own estate plan—before the water starts rising—let’s talk.